Whether you are E-filing your P11D, P46(Car), MTD VAT, RTI, CIS300 data to the HMRC or getting CIS Verifications from HMRC, the process is the same:

- First download the respective spreadsheet template from our website.

- Second populate your P11D / P46(Car) data onto the spreadsheet and then save it as a CSV file.

- Third upload it to our system, we will automatically convert it into an XML file and e-file it for you.

- Fourth is download or print out the successful E-filing certificate.

E-filing Specialist's E-filing of your P11D and the P46(Car) can now be done easily through the web-based on-demand system as the system helps you to convert your P11D and the P46(Car) data into the HMRC required standard.

The E-filing Specialist server is capable of converting your spreadsheet/CSV file data into the HMRC required XML format and then E-filing that data for you.

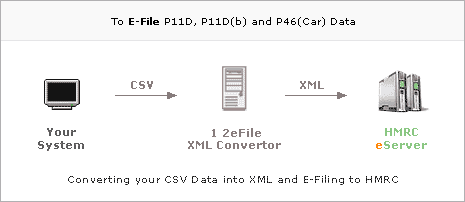

How it works?

To e-file your P11D, P11D(b) and the P46(Car) you simply need to save the data you have processed in your system into spreadsheet/CSV file and then upload it to the E-filing Specialist server. Once your CSV file is uploaded, the server will convert it into the HMRC required XML standard and then automatically e-file it for you, together with any iXBRL Accounts to the HMRC.

The whole process is as easy as sending an e-mail with an attached file. Virtually no training is required. You can now do away with all the EDI hardware.

The system, capitalising on cloud computing technology advantages, is ideal for organisations who have an in-house ERP system or bespoke software, or a Software House which is capable of generating the correct file output but needs a mechanism to e-file. The mechanism for E-filing is what we specialise in.

Using our system will save you from having to re-invent the wheel and repeat the development work relating to the HMRC XML or EDI E-filing submission protocol and other compliance requirements. Our system, which has a proven track record of many years, is available for you to use today.

Being a browser-based system, E-filing Specialist will work side by side and be compatible with your ERP, your bespoke system, or your current package software, be it running on Windows, Unix, Linux or Apple. If you have a large volume or are a software house, we can arrange a special tunnel between your system and ours under your own label (white label services).