CIS 300 Data Rectification Service to HMRC - current & upto past 6 years

You can rectify your HMRC CIS Subcontractor Payment errors by the approaches mentioned below.

If you’ve identified overpayments, missed payments or miscalculations in your CIS 300 submissions to HMRC over the past 6 years, our CIS Data Rectification Service helps you correct them quickly and accurately.

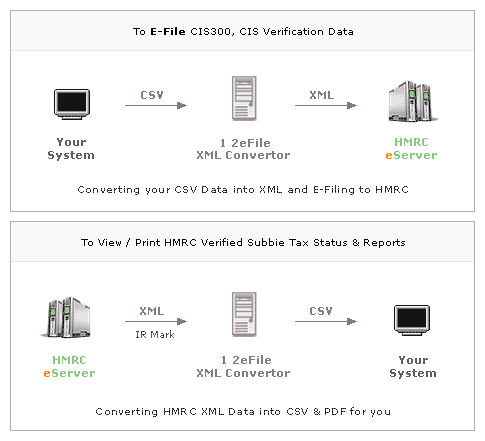

Our easy-to-use platform accepts standard CSV files, allowing you to upload and rectify your data instantly. We handle the entire E-filing process securely and efficiently, ensuring full confidentiality in a UKAS Certified ISO/IEC 27001 and ISO 9001 environment at a highly competitive cost.

To rectify the errors, you must re-submit the full CIS 300 return, including all entries, not just the one's with the error.

For example: If your previous CIS300 return included 100 subcontractors and you missed one, your amended return should now include 101 subcontractors. Conversely, if you need to remove an incorrectly added subcontractor, the amended return should include 99 subcontractors. This ensures that HMRC receives a complete and accurate record of all subcontractor payments for that period.

1. Current Tax Year Data Rectification

- Amended CIS 300 returns

2. Past Tax Year Data Rectification

- Amended CIS 300 returns